EP 275: From infrastructure consulting to public finance investment banking, with Ying Chen Axt

Episode Description

Ying Chen Axt spent six years as an Infrastructure project finance consultant before taking a nine year career break. While on career break, working around her child’s schedule, she studied for and passed the three rigorous and notoriously difficult Chartered Financial Analyst exams to gain the highly regarded CFA credential.

“It turned out the experience of studying for the CFA was instrumental: it not only helped me sharpen my technical skills, but also built my confidence and networks in the process.”

Using the knowledge gained from studying for the CFA, and leveraging her interests in infrastructure project finance and public finance, Ying recently landed an offer from a public finance investment banking team of a boutique women-owned, women-led investment banking firm.

We will get into the details of Ying’s career relaunch journey in today’s conversation.

Read Transcript

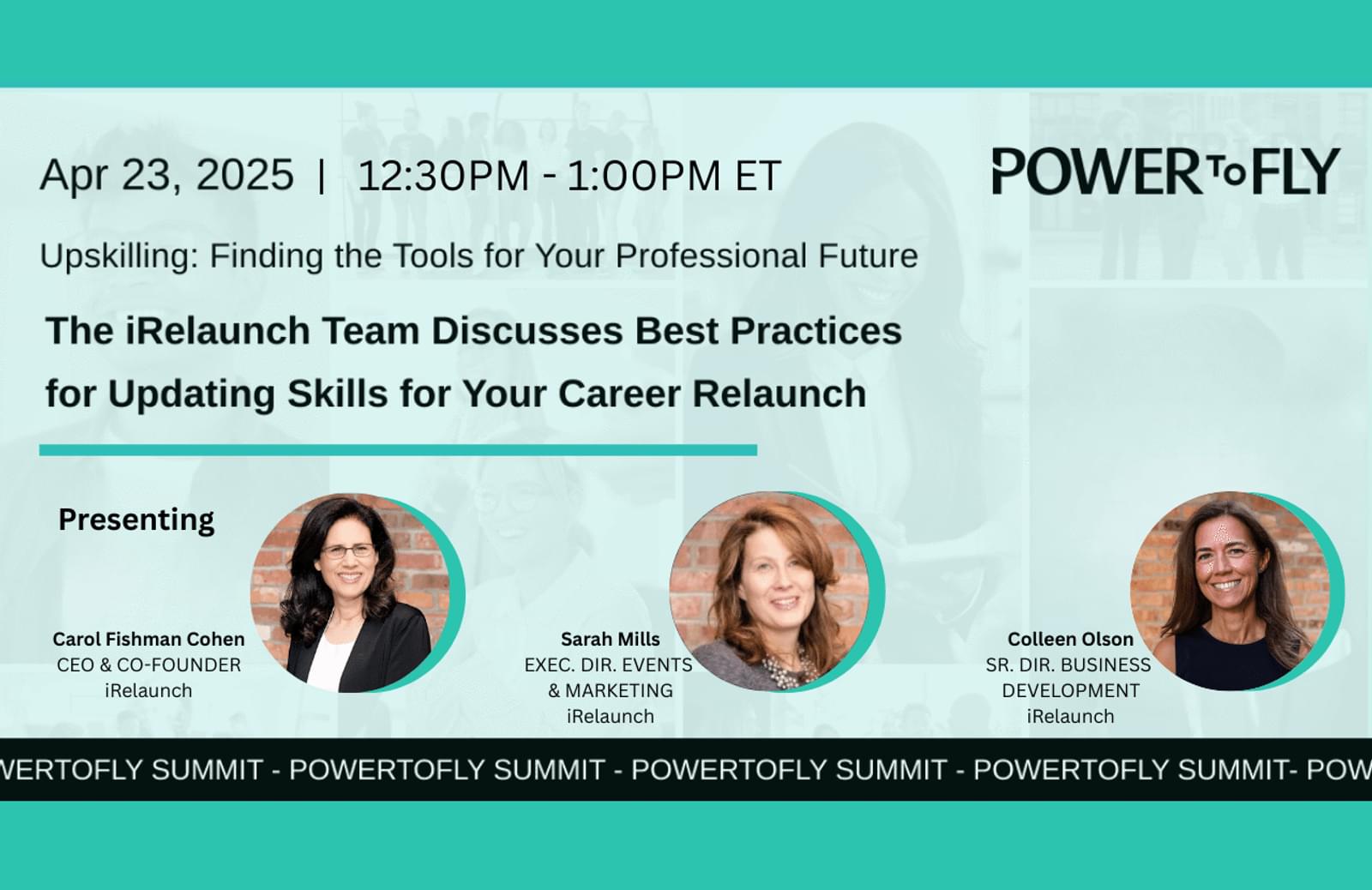

Welcome to 3,2,1 iRelaunch, the podcast where we discuss return to work strategies, advice, and success stories. I'm Carol Fishman Cohen, CEO, and Co-founder of iRelaunch and your host. Before we get started, I want to remind our listeners who are actively relaunching to. Register on our job board and upload your resume there because we have employers looking for relaunchers who go specifically to our job board to hire people coming off of a career break. So, please do that.

And now let's go on to our conversation for today. Today, we welcome Ying Chen Axt. Ying found her passion in public finance and capital markets during her early career at the [00:01:00] World Bank China Mission. After earning a master's degree in public administration, an MBA at the University of Southern California, she consulted on infrastructure project finance for six years in Washington, D. C.

Ying began her career break in 2012. During her career break, Ying studied the Chartered Financial Analyst, the CFA program, and earned the CFA designation in 2018. And we're going to talk about that because, there's a lot involved in doing that. Ying completed the Fitch Group Credit Path Returnship program.

And then the following year, she relaunched her career at a boutique investment banking firm with its public Finance investment banking team. In this episode, we will speak with Ying about how upskilling during her career break and networking in a different industry enabled not only her relaunch, but also her career transition from consulting to finance. [00:02:00] Ying, welcome to 321 iRelaunch.

Ying Chen Axt: Thank you, Carol. I'm excited to be here and have a good conversation with you. I appreciate the opportunity to share my story with your audience.

Carol Fishman Cohen: We're really excited to hear from you. And I also want to note how generous you have been with our iRelaunch Return to Work Forum Facebook group, where we have probably 15, 000 of our most active relaunchers in our much larger 120, 000 person community and we so appreciate when relaunchers in that community stay in the community after they relaunch and then give advice to people who are earlier stage, and you've been doing that and I just want to say thank you for as we start off.

Ying Chen Axt: Yes, that's my pleasure.

Carol Fishman Cohen: Yes. Let's, so let's get into this. We already talked about in the introduction that your professional background was consulting on infrastructure, project finance, and capital [00:03:00] markets in your earlier career. And you did that for six years before your career break.

Can you tell us what prompted you to take your career break?

Ying Chen Axt: Okay. I moved from Washington DC to the twin cities area in Minnesota. It is my husband hometown. I prioritize, at that time I prioritized family needs and I think Minnesota is a great place to raise a family.

Carol Fishman Cohen: All right, so I totally understand there's a relocation there, you're raising your family and then we talked a little bit in the introduction and I promised we would get back to this.

You ended up taking the CFA exam, actually set of exams and to get that certification I'm aware that it's very demanding. So I'm interested. How did you even get the idea in your head that you wanted to go for the CFA designation and how did you push through those three levels of studying and the exams [00:04:00] while you were working on it?

Ying Chen Axt: I'm motivated by my intellectual curiosity. I found my passion in public finance and capital market in my early career. When I worked for World Bank China mission, I was, intrigued by the cash flow models, developed for P3 water projects, and I learned firsthand how sustainable infrastructure investment improved the quality of life in local communities.

And that time, my supervisor in the World Bank was a CFA charterholder. But I didn't know I would pursue CFA at that time. I just followed the energy, finance. I, after earning my, in the graduate actually, in the graduate school, I selected all the accounting and finance related courses, and I was hungry for more.

So I went on to [00:05:00] select an advanced finance course in the business school. And I loved the experience. When I had some free time during my career break, it felt natural for me to pick up CFA curriculum. I remember I went through the level one books and, I feel I can understand 80 percent of it, although I'm not a finance major.

I didn't have an MBA. My graduate study was Master of Public Administration. I just enjoyed the whole process.

Carol Fishman Cohen: Wow. Let me also just recap for our audience. CFA stands for Chartered Financial Analyst, and it is a designation that people who do equity research and research of all different assets and public and private and who are money managers, anyone in that field would be really interested in someone [00:06:00] who has a CFA in part because it's known to be a very difficult designation to get. And then what happened with level two and level three and how long did it take you to do this from start to finish? Do they give you, do they cap the amount of time that you have to do it within or you can be on your own schedule?

Ying Chen Axt: No, I don't think there, you have to do it within a time frame, but on average at that time people spend four years to complete the three levels of exam, partly because at that time CFA exams are paper based. And for level two and level three, you could only do it once a year. I failed at the first attempt for level two, and it was very close.

But I still have to wait, study all over again and wait another year to take level two again, but now good news is during COVID pandemic, CFA institute [00:07:00] changed a test in, into a computer based. So it's possible that you could finish three levels of exam faster.

Carol Fishman Cohen: It's really, and it's not uncommon to just, so the audience knows to fail on these exams and take them multiple times, but the idea that you have to, you had to wait a year to take it again, and now you can do that in a much shorter timeframe is a huge deal.

So Ying, were you thinking about this impacting your career post career break and thinking about some sort of career transition or were you taking this in general and you were not sure where you're going to apply it?

Ying Chen Axt: I wasn't sure. I don't even know anybody who has within my, network who are in the finance industry at that time.

So that's why I took a gap year between level two and level three. So as I studied level two for two years. [00:08:00] So at that time I feel like, Oh, I studied so much. Let me figure out how do I apply those knowledge. And also I want to know some CFA charter holders person. So I know if I would like to be associated or to be belong in the association.

So I started the open end like open ended research and exploration to figure out my future direction, whether or if I would like to take level three at that time, I, I have very open minded. I was very open minded at that time. So I started my research from two professional organizations in Minnesota.

One is CFA Society of Minnesota, another one is Minnesota Society of Municipal Analysts. So I started to participate in luncheons and initiated coffee [00:09:00] chats. I did so many of coffee chats. Those coffee chats, the topics are not focused on me, my job search, whatever. It's focused on what they are doing.

So people like to talk about what they are doing. And each time I gain a little bit insights on the finance and investment industry and CFA Society, Minnesota, they organized a mentorship and I signed up for that and through this mentorship. program, one of the mentor introduced me to another senior portfolio manager, in a finance firm, because she knows someone who knows municipal finance because of my background in public finance.

So then I reached out to this manager and tell him that I'm interested in municipal [00:10:00] finance. And would you like to mentor me just to give me some exposure to the industry? And he agreed and he was very generous. And, we decided to. meet once a month in his office, and then I would always open my, our conversation, ask him, what's going on in the municipal market.

And then he would tell me something. And then I would ask him some questions because I always have some questions. I started to, I think CFA program after I passed level two, it opened a window for me. So in the past, I don't necessarily enjoy reading Wall Street Journal or economist , but I started reading those articles in those newspapers.

And so I have my questions sometimes, I can directly refer to [00:11:00] this senior manager so he can answer my questions. So it was always pleasure. It's just part of the learning experience.

Carol Fishman Cohen: Wow, so much great, so many great decisions that you made and, just ideas that you had to join the two professional associations.

They made sense for you to be in them because of your infrastructure project finance background on a municipal finance side and obviously the CFA. And it's such a great way to be connected to people in that you're, everyone's either working on their CFA designation or they already have it. And then to have the opportunity with that mentorship program.

And I love that you started reading the Wall Street Journal, and then there would be things you didn't understand. And that was some of the basis for the conversation with the mentors. So there were so many. reasons for having that conversation and I'm guessing the mentor was really impressed with your [00:12:00] intellectual curiosity and your deep interest in, in, in the field.

So I, I can see why those conversations were so enriching. And so then all this is going on, you're still on career break, give us a little sense of the time frame. So how you're taking the CFA exam, you had to wait till the following year, so that's a two year process. During that two years, that's when a lot of these conversations and this mentoring happens.

Ying Chen Axt: Yes. Because I didn't have experience on investment industry. So I feel all I learned is from books, from CFA program or other newspapers and through my conversations with people in the industry, I learned those knowledge again from real world experiences, and it may not be hands on, it's not like I'm [00:13:00] working a real job, but it's real world experiences, it's deepened my understanding of what I learned from books.

And I can give you another example, people in the professional organizations, they are so welcome, for people who want to learn, they showed a lot of support. I was invited into the planning committee of the Minnesota Society of Municipal Analysts. So we, our committee plan the luncheons and other activities for the members. And so I proposed that we could have a public private partnership infrastructure program for municipal analysts in the twin cities area. Then I started out to reach out to get the speakers. And, I just, out of [00:14:00] coincidence, I found one of my son's child care class. I noticed the one parent's email.

It was with, he works with a very well known law firm, and I know this law firm has a specialty in public private partnership. So I didn't reach out to him from email, I decided to wait until the next field trip of my son's child care class to see if he will be there and he was there and I just went up and asked about, Carol, did some small talks and then I moved down to introduce our organization society, Minnesota Society of Municipal Analysts and I told him we're doing this P3 infrastructure program, and could your firm provide a speaker for us or talk about your experiences [00:15:00] in this area? And then he said, yes. And then later on, we exchanged emails and contacts. And then, and then I worked with other committee members. We, we figured out and he was, he said, Oh, our expert in this area is based in Southern California.

And he actually, fly this expert from Southern California to Minnesota for our program. And, and also we so our committee members and this expert in Southern California and this, my son's childcare class parent, dad, and we had a, working meeting brainstorming the topics.

Carol Fishman Cohen: And, and you're in the mix.

Ying Chen Axt: So it worked out. And, The program was a hit, and over 35 municipal analysts attended our program, [00:16:00] and a lot of people couldn't make it at that time. They asked about the presentations, so that was just another example of whole thing came about. Relaunchers, they need to reach out to professional organizations and yeah, just so that's life's the ity serendipity.

Carol Fishman Cohen: Yeah, absolutely. I want to skip to something because, one of the things that caught our attention about you and your relaunch is you wrote a very frank blog post about your experience. And, we're talking about all this momentum and the conversations and so many great ideas that you had with your job search.

But I just want to read a quote from what you wrote about when things were really hard, and when you were in the depths of feeling like there are obstacles and rejections and here's what you wrote. "The process of relaunching my career was much longer than I anticipated. It was hard [00:17:00] and painful. Rejections and failures can be overwhelming and heartbreaking from time to time. I had to take short and long breaks from my job search in order to take care of my physical and mental health. I learned it's okay to take breaks. My wellbeing is the ultimate. priority." Ying, can you comment a little bit on that period and, and, just this whole idea about taking breaks and, how you manage through that?

Ying Chen Axt: Yeah, I know some people may could relaunch in six to nine months and it's relatively easy, but not always, not for all of us. For me, it's a journey of several years and there are, in my opinion, several stages of pains. I would like to mention a little bit about the transition from my research and study period to the [00:18:00] transition.

I'm actively seeking opportunity employment opportunities. So about my son, when my son was three and a half and four years old, I suddenly realized I have more free time and he was totally potty trained and he can sleep through the night for nine to 10 hours.

Carol Fishman Cohen: That's unbelievable.

Ying Chen Axt: Yeah. And my husband could get involved in childcare more actively. They go out, they could go out for biking and they went out fishing and my son even won fishing contest. So they had so much fun. So then I thought, okay, I'm going to use this, my new found freedom to apply for jobs. And, I sent, I dust off my resume and send out applications and, for a [00:19:00] while, I just received no response.

Carol Fishman Cohen: Yeah, not even a rejection, right? Just like nothing.

Ying Chen Axt: Yeah, that's some relaunchers mentioned. It's like a black hole and it's very depressing. Anyways, I keep improving my LinkedIn profile, my resumes, and I read some articles about resume writings. And then gradually I started to have interviews, but I was often rejected during the first round of interview. That's, I guess that's another stage. So my interviews was okay at that time. My understanding, I could land some interview opportunities in areas I would like to pursue. However, I need to improve my interview skills. So I focused on that.

And one story is I got to, got connected with [00:20:00] someone's through the, I can't remember is through the iRelaunch conference or iRelaunch Facebook private group. And, so we shared some similarity, we were both relaunching our career and we are both USC alumni.

Carol Fishman Cohen: University of Southern California is USC.

Ying Chen Axt: Yeah. And also, he, she had some, finance industry as well. And so we decided to practice our interview, through a online meeting. Then we criticize each other. That's a way to practice. And I just feel it's so beneficial to have a sounding board and it's some sort of encouragement along the way and make life easier.

Carol Fishman Cohen: Yeah, so that's another like great thing that you did was find, identify another relauncher so you're not going through the process [00:21:00] alone and you can do things like mock interviews of each other and critiquing and that's a huge step to be taking. So first you said you were applying and you wouldn't hear anything.

Then you said you were applying and you were starting to get some interviews but you weren't moving on. past the first interview. And then after you did some of that, some of that practicing and also I'll just read one, one, one more piece, from the blog post article that you wrote, because you were talking about iRelaunch, and you said, "I myself restarted my career last year after persistent search and struggle. If you ask me only one source about returning to work, I would recommend iRelaunch.com," thank you for saying that, "whose mission is normalizing career breaks." And it's true. We are dedicated to content to support our relauncher community in every stage of their journey, returning back to work.

And you wrote, "you'll be connected with many [00:22:00] relaunchers who have career breaks on their resumes due to various reasons." And then you said, "I'm not affiliated with the company, but I benefited from their conferences and the iRelaunch Return to Work Forum the private Facebook group." You're still in a situation where it's very difficult and you're saying there was a struggle.

What shifted, after and after how long?

Ying Chen Axt: I would say during the last, maybe I searched for a job for three to four years and during the last a couple of years, I always end up in the third round interview, fourth round interview, and I sometimes reached out by recruiters. So I feel like my resume, my LinkedIn profile, my interview skills definitely have improved.

And also I clarified, narrowed down the areas I pursue. That also helps.

Carol Fishman Cohen: You've got more specific.

Ying Chen Axt: Yes. Yes. If you look at my LinkedIn profile, I [00:23:00] put it right there under my name is a public finance, municipal finance and infrastructure project finance. Those are the areas I focused on. And, so there's another story at that time, I already had an interview with Fitch return to work program, but I want to know more about how they interview with people.

So I have no connections in Fitch whatsoever in the credit rating. So what am I going to do? I went on the Facebook iRelaunch group. I just searched Moody's or Fitch, I'll see what conversation comes out. And then I follow the conversations, see to see who are maybe relaunched in the organization. So I did find one woman and, I reached out to her.

I don't know him, her at all. I just reached out to her through Facebook Messenger. [00:24:00] I introduced myself, I, as a relauncher, and I got to know Yu through this iRelaunch Facebook group, and I have an interview with Fitch. And, would you shed some lights on your interview with Moody's? And then she shared her, her experiences.

I think it's helpful. Yeah. It doesn't hurt at least. And he was, he has relaunched, sorry, she has relaunched her career for a couple of years and she moved on to another organization at that time. She also, yeah, she gave me a lot of support and advice when I sometimes, when I couldn't, I didn't hear back from interviewers and, I'm evaluating what should I do.

I reached out to her and ask her, this is a situation, how do you think?

Carol Fishman Cohen: And then you also mentioned, you actually attended our [00:25:00] conference in 2020, which because of COVID, was our first virtual conference and we still, may use the virtual model now because that means relaunchers from anywhere in the country can participate and companies, our employers, can participate anywhere in the country can, also participate instead of being in person in a particular metro area. And, you said it was helpful to attend the conference and I'm wondering, was it helpful because of the information that you got from employers during the couple of days where we interview employers about their programs or was it the virtual career fair and getting used to interacting with companies virtually that was helpful?

Ying Chen Axt: Yes, I benefited from all these events, the presentations. I remember Carol, your presentation is very comprehensive, very up to date. And I learned a lot and also other presentations from career [00:26:00] coaches and, But, focused on interview skills or, how to do your research. And I think they are all very updated, very relevant.

And I also try to make most of the virtual interview rooms, how do you call that? That's connection and I guess virtual booths. Virtual booths, and try to make most of that try to. Have a conversation with employers. I still remember clearly that 'own your relaunch.' That's what I learned and it has a sense of confidence.

And, I remember 'own your relaunch,' that is, if I have, what's the takeaway from that conference, I would say 'own your relaunch' 'own your relaunch.'

Carol Fishman Cohen: Definitely a great takeaway for sure. So Ying, I want to skip forward a little bit. You did, you ended up getting into the Fitch Credit Path program. [00:27:00] And then after that program, you ended up in a full time role at a boutique investment banking firm focused in public finance.

And I want to know, can you tell us a little bit of the key steps that were involved in you getting that role?

Ying Chen Axt: I was reached out by a recruiter specialized in public finance. investment banking. And, at first I held back because of my cxoncerns about investment banking. Number one is the work life balance, number two is a culture. So I was considering this option, but I didn't respond to the recruiter right away. And, I couldn't make up my mind. So I reached out to a contact I got to know [00:28:00] through the iRelaunch network. I mentioned before, we had a interview practice interviews, mock interviews online, and he, she also, lives in the northern California area, and we actually end up with a coffee chat in person. And, I asked her about this and she said, you really need to know the team to figure out the work life balance to ask specifically either to the recruiter or to the manager of the team, what is the work life balance and what is the culture. Sometimes culture, I don't know if you could find it all right away, but you definitely could have a sense of culture while during the interview process. So if you don't even follow the [00:29:00] process, don't meet people, how can you know about the culture? You cannot make any judgment from stereotypes. So then, I reached out to the recruiter and I just told him that I'm interested. And then he arranged all the interviews and he has a process of doing interviews.

And he, for important interviews, he even provided some kind of hints or some sort of instructions. I think it was a positive experience. When I graduated from the graduate school, that was before the online application and LinkedIn, and, I, found a job in Washington DC through a network in a school.

And, my manager at that time said, Oh, you're recently came through my email box, when I was drafting a job description, I was planning to send this job [00:30:00] description to some professors in my graduate school, and then I came across your at that time it's more like a personal kind of network.

I was networking with my school advisors, professors, and they reached out to their contacts. So I didn't have experiences of recruiters. So at first, I don't know how to deal with recruiters. And then during this relaunch process, I gradually to know more about recruiting the industry, and, I feel more comfortable and more positive about recruiters and they can be very helpful and be open minded.

And, I feel this special, very specialized recruiters, such as this recruiter I work with, he is specialized in public finance, investment banking, very, this kind of specialized recruiter is [00:31:00] very useful. And also network with recruiters in your area, that is very, location is also very important factor.

Carol Fishman Cohen: Yeah, also I'm just thinking about your, you have the infrastructure project finance background, you have your MPA, degree and you have that CFA designation. So there's a combination there I'm guessing may have jumped out at him if he was even doing like maybe a LinkedIn search for CFA and public finance or infrastructure or something like that. So obviously something about your background jumped out to him because he reached out to you.

Ying Chen Axt: Oh, I forgot, Carol, I want to mention that how did I know this recruiter? I moved back to California. And then I reconnected with my contacts in the [00:32:00] graduate school. One of the mentor I met during graduate school, he introduced me to this specialized recruiter in public finance, investment banking. So it's still, otherwise I probably wouldn't find, I wouldn't find him quickly, or I still could find him probably through LinkedIn, but there isn't this personal touch of my mentor mentioned him, and then I wrote an email to this recruiter saying, my mentor who and who introduced me told me to contact you and I'm and then at that time the bank, the recruiter told me I recruit bankers with a book of clients.

It wasn't me. I didn't have any experiences at that time. So we connected on the [00:33:00] LinkedIn anyways. So then time moves forward, I was loosely in touch with him, because I was dealing with other opportunities and other recruiters, and I wasn't sure what's my next step. So sometimes I just reach out to him to ask his advice and he knows I'm trying to enter the workforce, right? And when opportunity came last year, when there was a growth in the public finance investment banking, and some firms could have openings for junior level bacnkers or some people, even people like me who don't have investment banking experiences, and then he thought of me.

That was a few years probably [00:34:00] after, yeah, two years later after I first met, got to know him. I still haven't met him yet, but it was just, I got to know him in 2020 and then he reached out to me about this opportunity in 2022.

Carol Fishman Cohen: Like you stayed loosely in touch, you were top of mind for him because of staying loosely in touch. And then when you're in California, you got back in touch with mentors or professors from a few years before that, right?

Ying Chen Axt: That was a long time ago. I graduated 20, almost 20 years ago.

Carol Fishman Cohen: Okay. So this is a very important point. You reach back out, and people remembered you. So I want to underscore that for our audience.

So before we wrap up, because we're starting to run out of time, I just wanted to get a sense of some of the interview questions that you were asked, both for the Fitch Returnship and also [00:35:00] when you pursued the full time other role after Fitch. Were you asked technical questions about bond pricing or yield curves or anything like that?

Or were there any case studies that you had to work on as part of your interviews?

Ying Chen Axt: During Fitch's second round interview, they asked me to do a case study online and, they send out the case study to me through my computer and I need to keep the computer up showing that I'm not calling anybody for help or I'm doing it independently.

And then I read the case study and I did my analysis and then two managers came on board and then I presented my analysis. So that was the format for Fitch return to work program. But your audience [00:36:00] needs to check Fitch website, because I heard they changed the format this year. It may be different.

Carol Fishman Cohen: The people who are relaunching, who are considering a whole range of returnships, should join our iRelaunch Return to Work Forum and go in and ask questions about, we see this pretty regularly, who has recently interviewed for this program or that program? And can you talk a little bit about what some of the questions were? And there's a pretty robust knowledge sharing that's going on there around this exact topic. So I just wanted to mention that. And then later for the investment banking role that you have now, did you have to do any thing involving calculations or valuations or something that was more quantitative. What were the topics of the interviews questions?

Ying Chen Axt: I don't recall. I don't recall I did any calculations and the most helpful [00:37:00] preparation I remember was I have several examples of my projects and I followed the format of CAR, context, action, and the result.

And, I made them very, I practiced them. I made them within two minutes. And also I maybe put a little note on a card or something. So it's easier for me to refer when I do an online interview. Those things are helpful.

Carol Fishman Cohen: Yeah, for sure. And yeah, that's one of the benefits of online interviews is you can have notes for yourself around to, as cues or to prompt and that's great that you're illustrating that.

One more question before we wrap up. So when you're in your current role in public finance, you had to [00:38:00] take more exams, right? Three more licensing exams in order to be in your role and was that daunting to you? Because you were thinking, I thought I would never have to take another exam again after I did the CFA, or was some of the material overlapping?

And what would you recommend to our audience about that?

Ying Chen Axt: Yes, I had a, I remember I had exactly the same thoughts. Do I have to need to do more exams, but that's just the reality in order to get into the investment banking industry and I, in our area, public finance area, I had to take three different licensing exams.

And I think for the Securities, Industry's Essentials exam, SIE exam, it does have some overlap with CFA, so it covers some very general topics such as equity, fixed income, [00:39:00] asset, wealth management, economics, and for the other two, I took a series 52 and series 63. Those are very specialized exams.

So I don't think there are much overlap for this two exam with CFA. In terms of regulation rules, I think CFA covered ASICs professional contacts, but it doesn't cover specific regulation and rules. And FINRA, which are organizers of those exams, there are significant portions of regulations and rules you have to go over.

That's one difference. And also I feel it is very crucial to choose good curriculum or help. They have some providers, third party providers for those exams. So my point is to choose the one carefully, [00:40:00] because I noticed that the regulatory agencies, they published a guideline, a few pages of those exams.

It was up to the third party providers of the training materials to develop their own curriculum. So the quality can be various. But as for CFA, CFA published its own curriculum. And then the third parties published their own study guides, all that, and when i, I remember when I reviewed the CFA materials, if I have confusions, I couldn't, it doesn't make any sense or something like that, I always resort to CFA curriculum. CFA curriculum is very updated and very comprehensive. They give you examples or things for you to understand, I felt helpful. But for this FINRA, FINRA organized licensing exams, as I said, the guidelines are only a few pages and then it's [00:41:00] up to the training organization to develop their own programs.

So you probably want to spend some time to find the one that is suitable for you.

Carol Fishman Cohen: Very good advice. Ying, thank you so much. This has been such a wide ranging conversation. I'd like to wrap up with the question that we ask all of our podcast guests, and that is, what is your best piece of advice for our relauncher audience, even if it's something that we've already talked about today?

Ying Chen Axt: Career relaunch is a journey of personal growth. Enjoy your ride, but don't forget to appreciate your well being, your family, and other important relationships. I'd like to thank my husband, Ted, my son, Jio for being my cheerleaders and providing the space for me to explore and research.

Carol Fishman Cohen: It's wonderful. [00:42:00] It's an incredible message. And also I loved, how you're thanking the people closest to you for that critical support. Ying, thank you so much for joining us today.

Ying Chen Axt: My pleasure. Thank you.

Carol Fishman Cohen: And thanks for listening to iRelaunch, the podcast where we discuss return to work strategies, advice, and success stories.

I'm Carol Fishman Cohen, CEO and co founder of iRelaunch, and your host. I want to remind our listeners to check out all of our resources on iRelaunch. com, no matter where you are in your relaunch journey. Thanks for joining us.